The term “sustainable development” draws our focus towards the environmental and social issues that are challenging our development claims and the strategies we need to adopt in order to attain sustainability. But there’s another important issue which needs to be addressed in the path towards sustainability and that is “Finance”. Materialization of sustainable development plans is not possible without financial backing or it can be said that; for achieving sustainable development, a sustainable financial system is required.

With the growing demand of sustainability, the demand for quicker and hassle free financial services is rising too, especially for start-ups and MSMEs which are the drivers of sustainable development. This growing demand has led to the evolution of a new generation financial system that combines finance with technology and is usually regarded as “Fintech”. Fintech lending is gaining popularity in the world of business as it has eased off the complexities of the age-old lending system of banks.

Drawbacks of traditional bank lending process:

- Time consuming

Traditional bank’s lending service is highly time-consuming as it uses traditional methods for risk-assessment and analysis which further leads to delayed decision-making, especially for small business ventures and start-ups.

- Cumbersome procedure

The traditional banking requires a lot of documentation and multiple visits to the bank for approval of loans. The borrower needs to prepare a detailed and convincing business plan.

- Higher Chances of rejection

Despite fulfilling all the requirements and following the procedure, the chances of loan being rejected are very high. Around 75% of business loan applications are rejected by traditional banks.

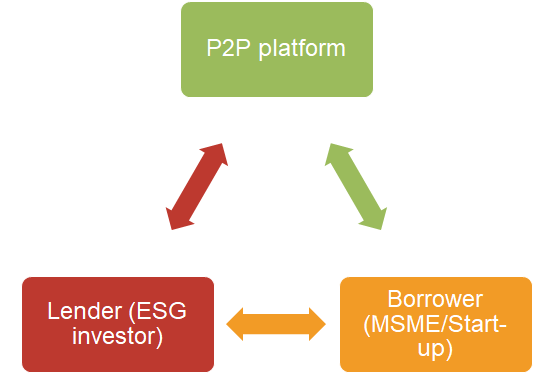

This type of lending system is not favourable for new business ventures that involve innovation and unique business models as banks look at them as risk factors, and are therefore turned down by traditional banks. However, innovation and new-thinking form the pillars of sustainable development and play the key role in the implementation of sustainable practices through a business plan. According to a recent survey, India needs around $2.5trillion to meet its climate-change actions by 2030. The same survey reported that scarcity of financial resources remains the biggest constraint in India’s progress towards meeting the Sustainable Development Goals. Fintech lending provides the perfect solution for sustainable business plans with unique needs and circumstances with the help of Data science and technology. It works on the principle of peer to peer lending which bridges the gap between lenders and borrowers by connecting them through a digital Platform. ESG investments have emerged as a popular trend over a past few decades and fintech lending has made such investments easily accessible.

Fintech lending has many advantages over traditional bank loans which are very helpful for implementing sustainable business practices

- Easy accessibility

Fintech lending is easily accessible for all, irrespective of one’s financial background as it operates through online platforms and covers a large portion of population even in rural areas.

- Hassle-free

Fintech lending does not require too much documentation and follows a simple and transparent procedure for lending.

- Use of technology

Use of artificial intelligence and data science for risk-assessment and analysis results in quicker and better decision-making. It uses alternate data, which is not directly related to a business plan, but is a helpful tool for assessing overall risk.

- Quicker

Fintech lending procedure is too fast and borrowers receive money instantly, this enables smooth running of a business.

- Lower interest rates

Peer to peer lending procedure lowers the rate of interest, making it highly affordable.

The accessibility, ease, flexibility and affordability offered by fintech lending are encouraging many sustainability-driven innovations, fuelling India’s Sustainable development program. The entire supply chain of a business can be maintained through the advanced tools used by Fintech lenders in their process. Fintech lending also provides the perfect backdrop for the “make in India” movement which is gaining tremendous popularity in the present context. The economies of nations across the globe have been badly hit by the COVID-19 pandemic and the recent anti-China movements are adding to the need to create new business spaces in India. India can make most of this opportunity by encouraging sustainability driven start-ups and small business and power its sustainability strategy. Fintech lending would prove to be very helpful in this process by serving to the unique needs and special circumstances required for India’s sustainable development program. The UN SDGs are an important tool for the practical implementation of sustainability practices. Some SDG targets can be directly linked to Fintech as it fulfils the conditions required to meet the targets.

SDG TARGETS WHICH CAN BE ALIGNED WITH FINTECH LENDING SERVICES

GOAL-1 (NO POVERTY)

Target 1.4: By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership and control over land and other forms of property, inheritance, natural resources, appropriate new technology and financial services, including microfinance.

Role of Fintech:

Studies reveal that 2billion adults, more than half of the world’s working adults, are still excluded from financial services. These adults include women, low-income groups, and hard to reach individuals. The inclusive, accessible and affordable services offered by Fintech lenders would help in lowering this figure(2 billion) to a great degree.

GOAL-2 (ZERO HUNGER)

Target 2.3 : By 2030, double the agricultural productivity and incomes of small-scale food producers, in particular women, indigenous people, family farmers, pastoralists and fishers, including through secure and equal access to land, other productive resources and inputs, knowledge, financial services, markets and opportunities for value addition and non-farm employment.

Target 2.A : Increase investment, including through enhanced international cooperation, in rural infrastructure, agricultural research and extension services, technology development and plant and livestock gene banks in order to enhance agricultural productive capacity in developing countries, in particular least developed countries.

Role of Fintech:

Fintech’s digital platform has made its services easily accessible to farmers and other people associated with agriculture and farming, even in rural areas. most farmers in rural India depend on age-old systems for their financial needs. These systems lack regularity and transparency, and consequently affect agricultural productivity. Fintech’s affordable, regular and transparent services would help farmers upgrade their techniques and ensure better food productivity.

GOAL-3 (GOOD HEALTH AND WELL-BEING)

Target 3.8: Achieve universal health coverage, including financial risk protection, access to quality essential health-care services and access to safe, effective , quality and affordable essential medicines and vaccines for all.

Target3.b: Support the research and development of vaccines and medicines for the communicable and non-communicable diseases that primarily affect developing countries, provide access to affordable essential medicines and vaccines.

Role of Fintech:

Most health coverage plans are Expensive, complicated, stressful and time consuming, prohibiting people from accessing health care services. Easy and affordable services provided by Fintech companies are making health care services and health coverage accessible for all.

GOAL-8 (DECENT WORK AND ECONOMIC GROWTH)

Target 8.3: PROMOTE POLICIES TO SUPPORT JOB CREATION AND GROWING ENTERPRISES

Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity and innovation, and encourage the formalization and growth of micro-, small- and medium-sized enterprises, including through access to financial services.

Target 8.2: DIVERSIFY, INNOVATE AND UPGRADE FOR ECONOMIC PRODUCTIVITY

Achieve higher levels of economic productivity through diversification, technological upgrading and innovation, including through a focus on high-value added and labour-intensive sectors.

Target 8.10: UNIVERSAL ACCESS TO BANKING, INSURANCE AND FINANCIAL SERVICES

Strengthen the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services for all.

Role of Fintech:

SDG 8 is the area where Fintech has the most important role to play. India has the world’s second largest unbanked population due to lack of financial-awareness, high-cost of banks and policy –gaps. Fintech has the potential to overcome this barrier and provide financial support to a large portion of population. With unemployment at its peak in India, there is an urgent need to promote Entrepreneurship and Start-ups as employment providers. Fintech provides affordable and hassle-free loans for such business ideas and has already supported more than 2000 MSMEs and Start-ups in India.

GOAL-9 (INDUSTRY, INNOVATION AND INFRASTRUCTURE)

Target 9.2: Promote inclusive and sustainable industrialization and, by 2030, significantly raise industry’s share of employment and gross domestic product, in line with national circumstances, and double its share in least developed countries

Target 9.3: Increase the access of small-scale industrial and other enterprises, in particular in developing countries, to financial services, including affordable credit, and their integration into value chains and markets

Role of Fintech:

Despite contributing 38% to GDP, MSMEs in India are struggling for financial stability. Only 10% of small businesses have access to formal credit in India. There is an urgent need of improved financial services to promote their growth and stability , which can be fulfilled with the quick and hassle free services, provided by Fintech. according to a recent survey, an estimated 9.2 million MSMEs registered under GST would benefit from fintech in India and contribute to the Nation’s GDP.

Apart from these SDGs, Fintech has the potential to support some other SDGs as well, by providing financial assistance to the projects aimed at meeting the targets of these SDGs.

SDG TARGETS WHICH CAN BE SUPPORTED BY FINTECH LENDING SERVICES

GOAL-4 (QUALITY EDUCATION)

Target 4.A: Build and upgrade education facilities that are child, disability and gender sensitive and provide safe, nonviolent, inclusive and effective learning environments for all

Target 4.B: By 2020, substantially expand globally the number of scholarships available to developing countries, in particular least developed countries, small island developing States and African countries, for enrolment in higher education, including vocational training and information and communications technology, technical, engineering and scientific programs, in developed countries and other developing countries.

GOAL-5 (GENDER EQUALITY)

Target 5.A: Undertake reforms to give women equal rights to economic resources, as well as access to ownership and control over land and other forms of property, financial services, inheritance and natural resources, in accordance with national laws

GOAL-6 (CLEAN WATER AND SANITATION)

Target 6.A: By 2030, expand international cooperation and capacity-building support to developing countries in water- and sanitation-related activities and programs, including water harvesting, desalination, water efficiency, wastewater treatment, recycling and reuse technologies

Target 6.B: Support and strengthen the participation of local communities in improving water and sanitation management

GOAL-7 (AFFORDABLE AND CLEAN ENERGY)

Target 7.A: By 2030, enhance international cooperation to facilitate access to clean energy research and technology, including renewable energy, energy efficiency and advanced and cleaner fossil-fuel technology, and promote investment in energy infrastructure and clean energy technology

GOAL-10 (REDUCED INEQUALITIES)

Target 10.4: Adopt policies, especially fiscal, wage and social protection policies, and progressively achieve greater equality

GOAL-11 (SUSTAINABLE CITIES AND COMMUNITIES)

Target 11.1: By 2030, ensure access for all to adequate, safe and affordable housing and basic services and upgrade slums

Target 11.2: By 2030, provide access to safe, affordable, accessible and sustainable transport systems for all, improving road safety, notably by expanding public transport, with special attention to the needs of those in vulnerable situations, women, children, persons with disabilities and older persons

GOAL-12 (RESPONSIBLE CONSUMPTION AND PRODUCTION)

Target 12.6: Encourage companies, especially large and transnational companies, to adopt sustainable practices and to integrate sustainability information into their reporting cycle

GOAL-14 (LIFE BELOW WATER)

Target 14.7: By 2030, increase the economic benefits to Small Island developing States and least developed countries from the sustainable use of marine resources, including through sustainable management of fisheries, aquaculture and tourism

GOAL-15 (LIFE ON LAND)

Target 15.A: Mobilize and significantly increase financial resources from all sources to conserve and sustainably use biodiversity and ecosystems

Target 15.B: Mobilize significant resources from all sources and at all levels to finance sustainable forest management and provide adequate incentives to developing countries to advance such management, including for conservation and reforestation

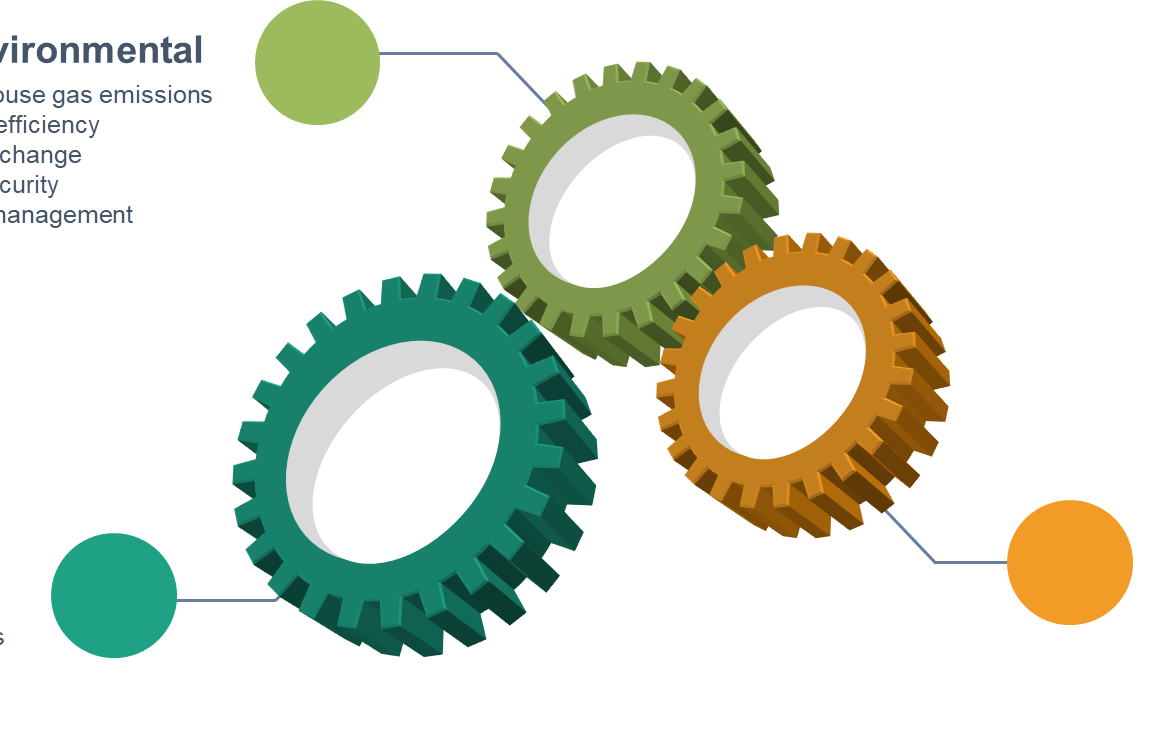

Environmental impact of Fintech lending

It is evident that Fintech lending has a major impact on sustainability through economic and social factors, but it also has a little impact on the environment too.

- Fintech lending operates entirely through digital platforms and there is no paper –work involved, this minimizes the use of natural resources.

- Since the lending process is carried out online, movement of people is not required at all. This enables saving of fuel and the entire process is pollution-free.

With only a decade left to meet the SDG targets, India needs to boost up its sustainability program and for this purpose both MSME sector and Fintech sector need to grow, collaborate and contribute to the sustainable development of the Nation.