ESG investing for sustainability

Our planet is in deep trouble and the challenges before it are a result of irresponsible human behavior over centuries. Humans have exploited their natural surroundings to an extent that has caused irreversible damage to the environment. The future of humanity is in grave peril and we need to put in strenuous effort to restore our planet. Sustainability has now become a priority for people across the globe. People involved in major human activities, such as economic, social and political activities are now following the path of sustainability to ensure a better future for all.

Enterprises now have a bigger role to play, apart from generating profit; they need to work towards improving the quality of life of people. The success of a business is now determined by the overall impact it creates, including financial, social and environmental impact. As companies are adopting responsible business practices, their investors are turning responsible too. Investors are now considering environmental, social and governance (ESG) factors while assessing a company’s profile for investment process and decision making. ESG factors determine sustainability of a company which further determines financial performance. Various studies conducted over a decade indicate that companies that follow sustainable practices generate good financial returns. Moreover investors want to invest for societal impact along with reduced risks and better financial returns. ESG investing is emerging as a popular trend and is growing rapidly.

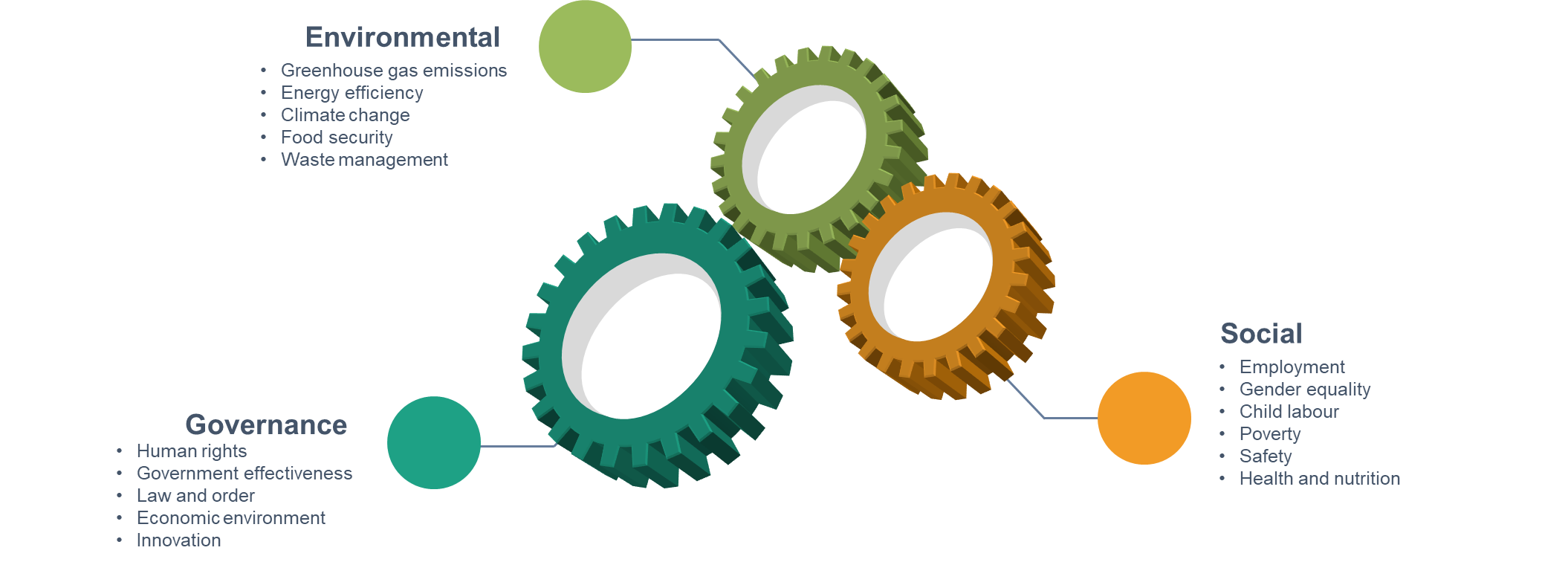

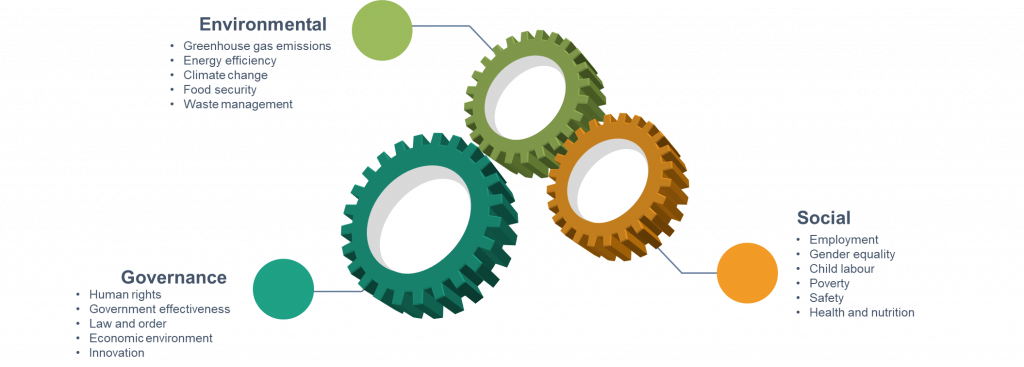

ESG factors indicate a company’s addressing of issues related to the three key factors; environmental, social and governance.

A company’s contribution towards handling these issues is measured by agencies which provide them with an ESG score. Investors consider these scores for analysis and decision-making. It may not be possible for a company to work on all these areas as part of their sustainability program; instead, it might pick up some of these issues to work on. An investor too might be interested to invest for a particular cause and might decide to invest in a company which works for that cause.

Another important tool that is helpful for ESG investing is “Sustainability Reporting”. Publishing annual sustainability report is a growing trend among companies. A company communicates its sustainability performance and ESG impact through its sustainability report. The report helps investors analyse and assess the true value of a company through its environmental, social and governance impact.

Role of SDGs

For fulfilling the ESG criteria, a company needs to design and follow a framework of sustainability targets and indicators which monitor the sustainability actions of the company. a company can achieve better sustainability performance by aligning its ESG framework with the UN SDGs. United Nations Sustainable Development Goals(SDGs) were adopted in 2015 by UN as a blueprint of 2030 agenda for sustainable development. There are 17 sustainability goals to be adopted by nations and organizations for creating a sustainable and more prosperous environment for all.

SDGs are not confined to the corporate sector like the ESG factors; they rather provide a broader perspective of sustainability of the planet through all sectors. The SDGs provide a universal, systematic and practical approach to achieve better sustainability standards. Assimilation of SDGs into the ESG framework of companies has proved to produce remarkable results. Many companies have adopted SDGs according to their area of interest for their ESG actions and have earned higher ESG scores. With growing awareness about the SDGs, more investors are willing to invest in companies working towards the SDGs of their choice. SDGs are influencing and empowering ESG investments by giving investors a clear picture of a company’s sustainability strategy and monitoring the same. SDGs also ensure reduced risks and better long-term returns in ESG investments.

A leading international bank, recently conducted a survey among investors who were involved in ESG investments. While, it was found that most of the investors work on developing ESG expertise, lets have a look at some of the findings:

These results clearly indicate that SDGs are gaining popularity in ESG investments.

Assimilation of SDGs into ESG factors

The 17 SDGs encompass almost all sustainability issues and each SDG has a set of targets and indicators to monitor the implementation of the goal. The sustainability issues related to the three ESG factors are similar to the SDGs and each SDG is related to one or more ESG factors. The table below explains the assimilation of SDGs into the ESG factors

Aligning SDGs with ESG framework is surely the future of ESG investing which is evident from the fact that presently there are over 1600 signatories involved in the initiative representing over USD 70 trillion in assets under management and this figure is likely to escalate in future.

Please contact us at sm@fandoro.com if you wish to get your SDG roadmap and reporting done. Visit https://enterprise.fandoro.com for more details.